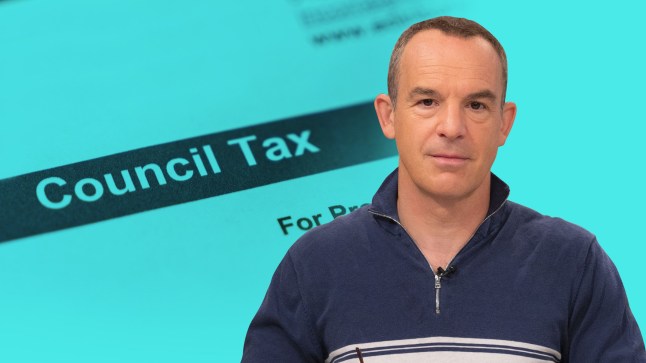

According to Martin Lewis, up to 400,000 UK households are overpaying their council tax — and could be due a sizeable refund as a result.

In the latest edition of his Money Saving Expert (MSE) newsletter, the consumer champion described the council tax system as ‘broken’, adding: ‘We still rely on a supposedly stopgap valuation done 34 years ago, to dictate what band a home’s in… even though much of the country is now unrecognisable compared to then.’

Last month, when he interviewed senior Cabinet Office minister Pat McFadden on Good Morning Britain, he was told the Government would soon be launching a consultation on the issue.

In the meantime however, Martin shared practical advice to make sure you’re paying the right amount, along with how to claim any money back you may be owed.

Check if your home is in too high a band

First off, Martin explains that, in England and Scotland, current council tax bands (from A to H) were decided back in 1991.

But in order to urgently get the system up and running, many homes were classified through ‘second-gear valuations’, with estate agents driving down streets and ‘allocating each property a band with just a glance’.

Although a full valuation was done for Welsh properties in 2005, almost half a million Brits could still be in the wrong band.

While you can’t ask for your band to be lowered, you can ask for it to be reassessed. And whether you should do so depends on whether you pass both of these simple tests:

- The neighbours check: You may feel comfortable enough to ask your neighbours for their band to see if yours is wildly different, but you can also look up your postcode via Gov.uk in England or the SAA website in Scotland.

- The valuation check: ‘The first check indicates something’s wrong, but is it that your band’s too high, or theirs too low?’ writes Martin. He recommends you first assess your home’s value (either based on what you paid for it or through house price websites like Zoopla Rightmove and Nethouseprices) then use this MSE tool to see what it was worth in 1991 — and thus which band it should be in.

Challenge your council tax band

Providing these indicate your home is in a higher band than it should be, the next step is to challenge its valuation with your local council.

Bear in mind though, Martin stresses the importance of passing both of the checks, as ‘even if you pass the neighbours check, you may be in a higher band than neighbours because theirs is too low, not yours too high. Challenge and you risk seeing their band rise, which won’t make you popular.’

If you’ve lived in the property for six months or less, or if the property has fundamentally changed within the same timeframe, you can submit a formal challenge. You can still submit an informal challenge if you live in England and Wales and don’t meet these requirements — it’s just a bit trickier.

Then, collect the following evidence to show the council that you’re likely overpaying:

- Your ‘Property Attribute Details’ (PAD) which can be obtained from the Valuation Office Agency (VOA) and includes factors like its age, type, floor area, number of bedrooms, living rooms, bathrooms and number of floors. This document isn’t available in Scotland, so Martin advises: you to ‘think about similar factors for your home, as they’re what really counts.’

- Addresses of similar properties nearby. These should be on the same street or estate (up to a maximum 10-mile radius in very rural areas), have the same style or features, and be of a similar age and size.

Once you’ve sent in the challenge, the council will decide whether your home’s band should be lowered. If they do, you’ll be offered a backdated rebate from when you moved into the property or 1993, whichever is later).

But not every challenge will be successful.

Martin does note that you can appeal a formal challenge rejection ‘if you have very strong reason to think the VOA is wrong’, either through a Valuation Tribunal in England and Wales or the Local Taxation Chamber in Scotland.

However, the financial guru adds: ‘If it’s an informal challenge and it’s turned down, you can’t appeal and that’s probably it – unless you find further evidence to support a new review (in which case, you’ll need to start the process again).’

Either way, you’ve got nothing to lose, and MSE followers have managed to snag rebates worth upwards of £3,000, so it’s worth a look.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.